Historically, CMS has pushed towards value-based care for programs that are “helping us move toward paying providers based on the quality, rather than the quantity of care they give patients.” Touted as a transformative reimbursement model, value-based care has historically been a vaguely-defined concept lacking concrete steps, and therefore resulting in significant variability in implementation.

According to the Health Care Payment Learning and Action Network (LAN)’s latest report, 25% of Medicaid payments were in an alternative payment model in 2017. HealthScape believes that a health plan with a meaningful Medicaid value-based care program provides a graduated scale to accelerate both upside and downside risk with providers. Meaningful requirements tie an increasing percentage of overall medical expenditures to performance thresholds that expose providers to real “skin in the game.”

HISTORICAL MARKET PARALYSIS: DIFFERING PERSPECTIVES

The State Perspective

Whereas Medicare is advancing towards meaningful value-based care, Medicaid value-based care has less momentum. The Medicaid program is in a pre-evolutionary phase in which a few progressive states are tipping towards large scale adoption with shared risk. While a majority of states have a Managed Medicaid program in which states use managed care organizations (MCOs) to manage their Medicaid population, most states either lack a value-based care program altogether or mandate incentive-only structures with minimal risk sharing. Few states have outlined explicit requirements and standards for broader adoption.

Provider Perspective

Similar to states, willingness of the provider community to adopt value-based care has itself contributed to continued market paralysis. Adoption of value-based care requires capital investment on the part of providers and with Medicaid reimbursement rates typically on the low end across all markets, providers have no incentive to seek such contractual arrangements within the Medicaid environment.

MCO Perspective

As the healthcare industry shifts from volume to value, some states have become more bullish on tying capitation payments to plan performance, making it a strategic imperative for MCOs to accelerate scalable adoption of value-based requirements. Although MCOs recognize the need to shift to value-based care, the lack of clarity and definition around value-based care have impacted the uptake of these arrangements.

While state agencies push MCOs towards value-based care, MCOs push providers towards achieving those requirements, further demonstrating there is critical mass for participation.

STATE VALUE-BASED CARE FRAMEWORK

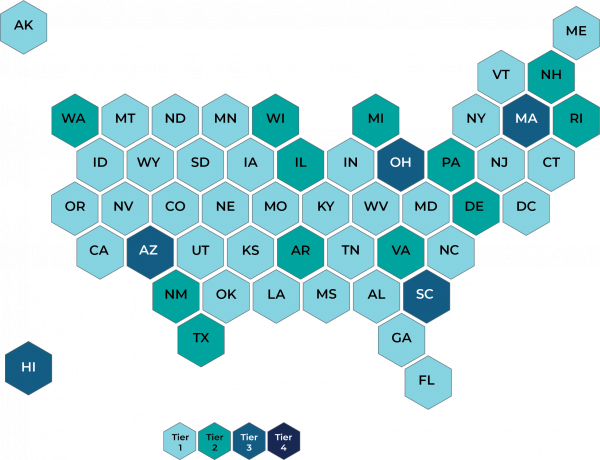

HealthScape profiled each states’ disposition relative to value-based care for two contracting periods—previous and current. Findings from this analysis demonstrate that states (including Washington D.C.) can be classified into four tiers:

- Tier 1 – No info available or state has yet to adopt value-based requirements

- Tier 2 – Requirements primarily linked to incentive- based / upside only arrangements; do not specify performance thresholds

- Tier 3 – Requirements stage multi-year guidelines for performance (outline thresholds) and encourage shared upside and downside risk with providers (not mandatory)

- Tier 4 – Requirements mandate multi-year standards for achieving performance thresholds and shared upside and downside risk with providers

Exhibit 1: Value-Based Care State Disposition During Previous Contracting Period

Note: Tiers based on publicly available information on state websites during the time of this analysis. Any states not considered to have a comprehensive managed care program were qualified as Tier 1. This analysis did not review population or disease-state specific programs (e.g., TANF, IDD).

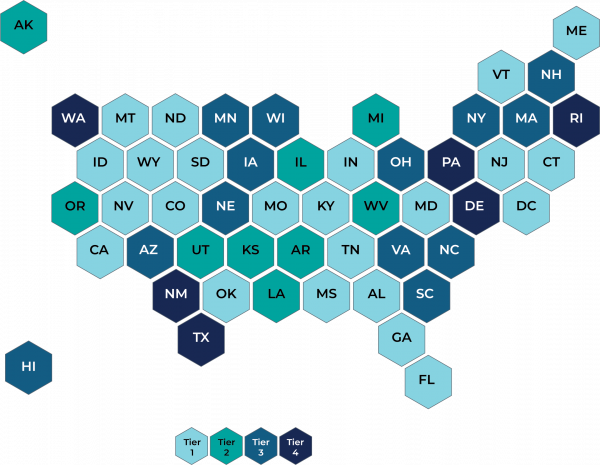

While a majority of states had not defined a value-based care program during their previous procurement / contracting period (see Tier 1 in Exhibit 1), nearly half of all states had still not defined a value-based care program in their current contracting period (see Tier 1 in Exhibit 2). However, there is a significant uptick in states shifting to a higher level tier (Tiers 2-4) when comparing the two maps signaling not only a gradual emergence of value-based care models but also a carte blanche opportunity for development.

Exhibit 2: Value-Based Care State Disposition in Current Contracting Period

MARKET PULSE

The following section compares Medicaid value-based care requirements from a sampling of Tier 2 and Tier 4 states in the current contracting period (Exhibit 2). This comparison highlights not only the range of standards but also the diversity of programs states have adopted to advance value-based care.

| TIER | STATE | KEY TAKEAWAY | VBC APPROACH COMMENTARY |

|---|---|---|---|

| 2 | Michigan | Encourage VBC payment models but lack specificity around requirements and standards of success. | Requires MCOs to “to increase the total percentage of health care services reimbursed under value-based contracts over the term of the agreement” but does not dictate acceptable levels or progression of medical spend at risk. |

| 2 | Kansas | ||

| 4 | Washington | Require MCOs to adopt more sophisticated VBC payment models over the life of the contract. Both states designate a graduated schedule for percentage of provider payments in value-based models and specify the portion that may be withheld for non-compliance. | |

| 4 | Texas |

| |

| 4 | Rhode Island | An example of a state that leveraged a pilot program to test the effectiveness of specific initiatives. |

|

While each state takes a unique approach to designing its value-based care program, there is a single underlying theme—all states are driving towards Tier 4 requirements. MCOs must recognize there is a holistic, integrated shift and states are not immune to each other’s value-based care philosophy. As states are on an accelerated path towards Tier 4, most are undergoing logarithmic change.

MCO ACTIONS

As Medicaid contracts and RFPs become increasingly saturated with requirements encouraging value-based care, MCOs are often left to fend for themselves. However, regardless of the level of sophistication within a state, there is a path for MCOs to align with many of the requirements (e.g., establish high performing networks, deploy provider tools and technologies, administer contracts that enable risk sharing) and much of that begins with integration. Although integration will require investments in expertise / resources and technology, doing so will materialize into a positive impact with minimal operational disruption.

1. Integrated Network Strategy

Aligning with providers optimizes value-based contracting and increases accountability that providers have towards providing efficient, quality care. It is critical for Medicaid contracts to incorporate and integrate all providers including specialty health (e.g., dental, behavioral health, vision, pharmacy) to provide a wholistic view of the member. As the front line of defense, their insights into the social determinants of health impacting care can be a feedback loop to the plan to help address member needs and lower cost of care.

2. Technology Infrastructure and Analytics

Actionable reporting and analytics are key enablers to provider adoption of value-based contracting. Given that behavioral health plays a more pronounced role in the health of this population, integration of physical and behavioral health is imperative. Specifically, analytic tools and the underlying infrastructure must allow providers seamless access to critical data for a comprehensive view of member needs and health status.

3. Utilization and Care Management

Coordination and consistent application of utilization management, care management and disease management programs and policies are increasingly important as states require a growing percentage of medical spend in value-based care. MCOs that establish processes, tools and parameters (specifically through UM) to relieve the burden on providers are best positioned to ensure appropriate care is rendered. Different populations will require tailored care management plans, programs and policies based on the needs of the population (e.g., ABD, LTSS, TANF). MCOs may opt to focus on a specific population before trying to address all populations simultaneously.

PATH FORWARD

The absence of meaningful value-based care requirements in state contracts does not indicate a “do-nothing” scenario. Because the current standard for value-based care is low, MCOs that lay the groundwork for advancing internal initiatives that support value-based care will be well positioned to reap the benefits of an operational infrastructure primed for these universal shifts. MCOs will impact member care and realize cost savings even if the state has not taken proactive steps. The teams at HealthScape and its sister company, Pareto Intelligence, have helped plans navigate through the maze of state requirements to implement effective and sustainable value-based care programs.

Footnote: For purposes of this discussion, value-based care, value-based payment and alternative payment models are synonymous.

HEALTHSCAPE AND PARETO CAN HELP.

As the healthcare industry becomes more bullish on adopting value-based care across all lines of business, HealthScape and its analytics affiliate, Pareto Intelligence, have gathered extensive experience helping clients grow their value-based care footprint for the Medicaid population. This work translates value-based care requirements into actionable strategies that augment rather than disrupt existing processes. Contact Elissa Glavash at (312) 256-8626 or eglavash@healthscape.com for more information.